Competition Law in India: Strengthening Regulations for a Dynamic Economy

Fair competition is fundamental to the success of any thriving economy. In fast-growing markets like India, maintaining a level playing field is essential in fostering innovation, ensuring market integrity, and protecting consumer interests. The Competition Act 2002 plays a pivotal role in this regard. It focuses on regulating anti-competitive agreements, preventing the abuse of dominant market positions, and overseeing mergers, acquisitions, and amalgamations that could potentially harm the prospects of competition in the market. With the rise of digital markets and increasingly complex business combinations, the act continues to evolve to address emerging challenges. In this article, we will explore the key aspects of the Competition Act, its evolving role, and the latest advancements in the field.

The Competition Act, 2002: Its Objectives & Scopes

The Competition Act, 2002, was enacted by Parliament and was approved by the Hon’ble President of India through the official gazette in 2003. The Act aims to sustain market competition and protect consumers by preventing unfair practices. The Act has several provisions aimed at:

Prohibition of Anti-Competitive Agreements

Agreements that adversely impact competition, such as price-fixing, bid-rigging, market allocation, etc., are void under the Act. It includes both horizontal (between competitors) and vertical (within the supply chain) agreements hindering developments, limiting production or access to consumers.

Prevention of Abuse of Dominance

Imposing unfair pricing (which could be excessive or artificially low) or deliberately restricting market access for competitors is forbidden under the Act.

Regulation of Combinations

The Act scrutinizes Combinations (an umbrella term used for mergers, acquisitions and amalgamations) exceeding specific thresholds to ensure such actions do not adversely impact market competition.

Further amendments were made to the Act, the latest being The Competition (Amendment) Act 2023 and The Competition Commission of India (Combinations) Regulations 2024, to strengthen the existing provisions. Also, the Competition Act replaced the old MRTP (Monopolistic and Restrictive Trade Practices) Act 1969 via a notification dated 28th August 2009, which removed the ambiguities as to which law would regulate anti-competitive practices in India.

The Enforcing Body – Competition Commission of India

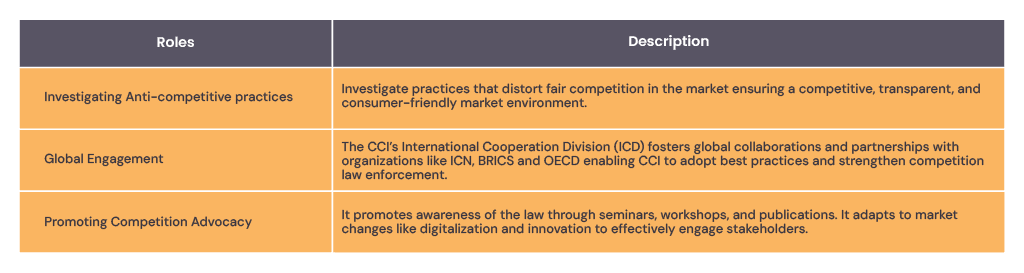

The Competition Commission of India (CCI) was established under the Competition Act, duly constituted in 2009 for the administration, implementation and enforcement of the Act. It is led by a chairperson assisted by two to six members appointed by the Central Government. The commission also comprises the Director General’s office and Secretariat in Delhi along with regional offices in Mumbai, Kolkata and Chennai for the western, eastern and southern parts of the country, respectively. The key roles of CCI include:

To safeguard the interests of consumers and businesses, the National Company Law Appellate Tribunal (NCLAT), constituted under the Companies Act, 2013, serves as the appellate authority under this Act. It handles appeals against the CCI orders and adjudicates claims related to competition law, ensuring fair enforcement and dispute resolution.

Surge in Mergers and Acquisitions (M&A) – Regulatory Adaptations and Challenges

The Emerging Need

In a growing economy like India, which witnessed a significant 38% increase in its M&A activity from 2023 to 2024, antitrust laws must remain vigilant. M&A can led to dominance in the market, paving the way for the abuse of such positions by being involved in anti-competitive practices like limiting output, price-fixing, forming cartels, etc. It’s essential that competition laws not only address these issues post-facto but also assess agreements that may harm competition.

Extended coverage

Previously, the Competition Act required entities meeting specific assets and turnover criteria to notify the CCI before entering into a combination. With the 2024 combination regulation, deal value has also been introduced as a criterion for assessment. The primary goal is to address ‘killer acquisitions,’ where large firms acquire smaller, innovative companies with high potential but low turnover or assets, thereby stifling future competition. This expansion of combination regulations ensures broader oversight as transaction volumes grow.

Investigation of combinations

The CCI has never blocked a combination in its history but has imposed modifications to ensure fair competition. In the recent ₹736 billion ($8.5 billion) Viacom18-Star India merger, it required divesting TV channels, ad pricing restrictions, and surrendering voting rights to prevent concerns arising from market dominance while allowing the deal to proceed.

The Green Channel Scheme

Introduced in August 2019, to avoid unnecessary piling up of cases pertaining to combinations, this scheme allows automatic approvals for combinations that do not possess risk of harm to the competitive environment. It provides a bypass from the regular legal proceedings and aid in quicker administrative decisions.

Despite proactive measures, the CCI faces increasing complexity of merger filings, particularly in digital markets. The upcoming implementation of the deal value threshold is expected to refine its regulatory approach, aiding in robust competition analysis.

Future of Digital Markets – Regulatory Initiatives and Investigations

Draft Digital Competition Bill

The Growth of a dynamic economy, especially in the digital sector, demands a paradigm shift in the way competition law operates. In this regard, the Ministry of Corporate Affairs formed the Committee on Digital Competition Law in 2023 to examine the need for an ex-ante (detection of harmful practices before they occur) regulatory mechanism for digital markets in India. The Committee submitted a report along with the Draft Digital Competition Bill in February 2024, with a comprehensive approach keeping in mind the peculiarities of digital markets, a wide range of stakeholder concerns, and global regulatory practices. This trend of focus on digital market regulation is expected to continue in the coming years.

Market study on AI

The Govt has launched a market study on AI and appointed an agency to conduct market study in September 2024. The intention of this study is to develop an understanding of the emerging competition dynamics in AI systems and their implications on competition, efficiency and innovation in key user industries.

Prominent Investigations

CCI is actively investigating major digital platforms, including Apple, Amazon, Flipkart, Zomato, Swiggy, and Google. In November 2024, it imposed a ₹2.13 billion ($25.3 million) fine on Meta over WhatsApp’s privacy policy in 2021, which mandated data-sharing without an opt-out. The case, citing abuse of dominance marks a key milestone for India’s antitrust regulation.

Business & Entrepreneurial Perspectives

The Competition Act ensures freedom for businesses to compete on merits by restricting anti-competition activities in the economy. It prevents monopolistic abusive practices by dominant players allowing startups and entrepreneurs to sustain their innovative capacities. Let us look at the need to prioritize compliance with the law and the role of entrepreneurs in achieving the objective in the ensuing points:

Consequences of non-compliance:

Loss of credibility and market setback: Non-compliances can severely damage an organization’s reputation, leading to a decline in stakeholder confidence, including investors, customers, and business partners. A tarnished reputation may result in decreased business opportunities, reluctance from potential collaborators, and difficulty in securing investments or partnerships. Over time, this loss of credibility can weaken the organization's standing in the market and hinder its long-term growth.

Financial and criminal liabilities: Anti-competitive practices can lead to penalties up to10% of annual turnover, with cartel violations facing the higher of 10% of turnover or three times the profits. Further, non-compliance with CCI orders could attract fines up to ₹10 crores, while false statements can attract penalties up to ₹1 crore. Repeated violations can even lead to imprisonment (up to 3 years) or fines up to ₹25 crores, or both.

Building a Compliant and Competitive Business

Robust Compliance Program: Establish a well-structured compliance framework with clear policies and monitoring mechanisms to proactively detect and prevent potential violations. Regular risk assessments can help ensure adherence to competition laws.

Awareness and Training: Organize periodic training sessions and workshops for employees at all levels to enhance their understanding of the Competition Act and the risks associated with anti-competitive behavior. Encouraging a compliance-orientated culture within the organization can help mitigate risks.

Seek professional advice: Engage experts to clarify ambiguities and ensure regulatory compliance. Seeking professional guidance during mergers, acquisitions, or strategic business decisions to assess and address concerns.

Conclusion

India’s Competition Law is continuously adapting to meet the demands of a dynamic and rapidly expanding economy. By enforcing fair competition, regulating mergers and acquisitions, and addressing challenges in the digital sector, the Competition Commission of India plays a crucial role in maintaining market integrity. For businesses and entrepreneurs, complying with competition law is not merely a legal obligation; rather, it is a crucial step toward a sustainable business environment that benefits both individual enterprises and the broader economy.

Contributors

N Srilatha Bhat linkedin

Kuldeep Sarma linkedin

Poonam Vernekar linkedin